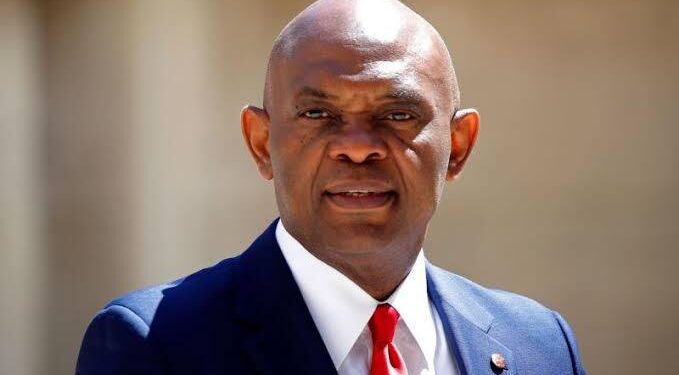

Multi-billion-naira entrepreneur and Chairman, Heirs Holding, Tony O. Elumelu, has advocated for a data-driven insurance industry for Nigeria.

He also said for disruption to happen in the industry, the entire insurance must embrace technology.

Mr. Elumelu delivered the keynote at the Nigerian Council of Registered Insurance Brokers (NCRIB) 60th Anniversary held in Lagos. The anniversary had the theme: “60 Years of Insurance Broking: Redefining the Practice and the Practitioners.”

Mr. Elumelu, which is also the Founder, Tony Elumelu Foundation also called for insurance brokers to go beyond conventions and break new grounds.

“ It is high time the brokers community began to shift focus to retail because this is where the future of insurance lies in Nigeria. Brokers have the capacity to lead in this area. Innovation and disruptive practices cannot occur if we do not broaden our thinking. Trying to make profits from existing lines is not going to deepen insurance penetration, rather we must look at the blue ocean opportunities. This is something I task the management of the insurance companies to constantly think of in product development and deployment” he said.

He also tased the NCRIB against unethical practices. “These include premium rate cutting, delayed premium remittance, unremitted premium, overloading of premium, returned premium, fake documents, fraudulent claims, collusion to defraud, mis-selling, unhealthy competition, misrepresentations, manipulation of policy conditions, self-enrichment methods disguised as marketing expenses, and many more” he said.

He also advocated for an increase in the minimum capital base of insurance brokers increased from N5 million to N50 million to meet current insurance appetite.

He said insurance brokerage firms need to be adequately capitalise to be competitive and innovative.

also said “to remain relevant in the modern business arena, the insurance broker community and, by extension, the entire Nigerian insurance industry, must embrace technology fully.”

He noted that the NCIB “needs to work towards positioning its members properly for digital integration, mediating between the insuring public and the underwriters digitally.”

“Embrace technology and digital adoption, current analogue processes need to be eliminated to improve service delivery to our customers” he said adding that “the brokers industry cannot advance when the other financial services are transitioning to online real-time and we are still stuck with a system that relies on hard copy files and documents. The brokerage sector needs to drive clean data for the industry” he emphasized.