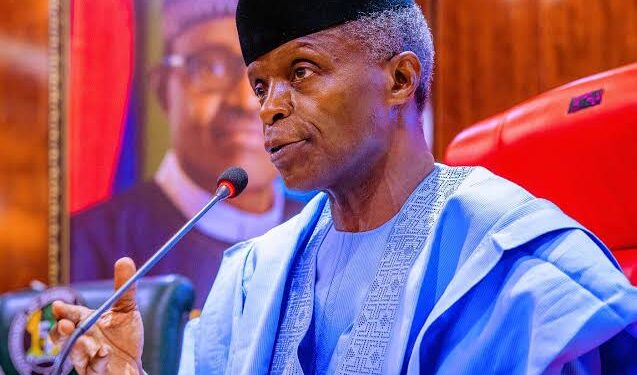

Nigeria’s Vice president prof. Yemi Osibanjo has said the Nigerian government is deeply worried about the exchange rate volatility saying the arbitrage is huge.

“Our exchange rate regime remains of concern” and fueling arbitrage, Prof. Osinbajo told delegates at the 28th Nigerian Economic Summit #NES28.

The theme for the Summit is ‘2023 & Beyond: Priorities for Shared Prosperity.

He said: “ The discussion that we must have, shorn of sentiments, is how best to manage the situation by finding a mechanism for increasing supply and moderating demand which will be transparent and will boost confidence.”

“I am sure most can recall several efforts have been made in the past such as the Interbank Foreign Exchange Market, Retail Dutch Auction System, Wholesale Dutch Auction System, etc. While they may not have been perfect, the rules were clear and the gap between the official and parallel markets was not so wide. The thing is that there should be some element of price discovery in our policy regime. This will boost confidence and increase inflows of foreign exchange: he said.

He also spoke about reining in on inflation to propel the economy to growth.

“We will also have to take urgent action to bring inflation down because it is both a tax on the poor and disrupts long term growth. Inflation in Nigeria is partly structural arising from infrastructural deficiencies etc but there is also an aspect that is caused by increased money supply, imported inflation and depreciation of the naira. In addition therefore to the monetary measures being taken by the Central Bank of Nigeria, we would need to increase domestic production of food and make sure that it gets to the market.”

In this regard, he said we must pay closer attention to the institutional insight of the Agriculture for Food and Jobs Programme of the Economic Sustainability Plan which sought to support small scale farmers by guaranteeing uptake of their production through enabling bigger farmers, suppliers to manufacturing companies and commodity exchanges to support them across every stage of production.

Speaking to climate change, it is now evident that if there is one global issue that will impact local economies most profoundly it is climate change.

“But it bears repeating that African countries including Nigeria did very little to cause global warming but yet as recent floods all over the country show, we bear the brunt of it. We must continue to call for a just transition that enables us to use our abundant gas resources to meet our energy needs including for electricity and cooking. This will enable us to secure the resources needed for investment in natural gas as well as in renewable forms of energy.”

“Nigeria should continue to work alongside G77 and China partners on the issue of compensation for ‘Loss and Damage’. This is essentially requiring that those who caused the climate change-related challenges that we face should pay to help us overcome these challenges” he said.

‘I am happy that this matter is on the table at the ongoing COP 27. It should be pursued to its logical conclusion of securing additional finance for developing economies. At the same time, we must also include some of excellent ideas around debt for climate swaps in our climate finance tool kit. These swaps can be a win-win for debtors and creditors.

They will “increase the fiscal space for climate-related investments and reduce the debt burden for participating developing countries.” For the creditor the swap can be made to count as a component of their Nationally Determined Contributions(NDC). Yet another priority in the discussions around climate change is that of unlocking the potential of carbon markets especially in Africa.

“In short voluntary carbon markets work by the purchase of carbon credits by corporations in the developed world to offset their own emissions.

“The Africa Carbon Markets Initiative was launched last week at COP 27 and it has been estimated that Nigeria could produce more than 30m tonnes of carbon credits annually by 2030 bringing in more than $500m annually. The future are the jobs and opportunities from the green economy. We must press our advantage in renewable energy.

“The Solar Power Naija Programme launched under the Economic Sustainability Plan is designed to achieve 5 million solar connections impacting over 25 million Nigerians will contribute in this regard. But the impact includes opportunities in manufacturing and maintaining solar equipment and facilities.

“Another key priority for us should be to leverage disruptive technologies offered by digitisation. Digitisation is now upon us and it is different from previous advances in technology because it has become a general purpose technology affecting nearly every facet of life. However, we are now on the cusp of the 4th Industrial Revolution resulting from the increasing economic viability of advanced robotics, artificial intelligence, 3-D printing, the Internet of Things, cloud computing, big data analytics, and blockchain technologies.

“We have already seen the impact of digitisation in Fintech in Nigeria and the story of how our young people managed to create six unicorns in a period of two recessions is one that will continue to be told. We must build on these achievements which also offer us the opportunity to leapfrog by deploying digital technologies in agriculture, health, education, logistics, and even manufacturing, housing and smart power grids.