The management of Benue Investment and Property Limited (BIPC) has said the company is reeling in huge liabilities thus a restructuring is necessary to keep the company afloat.

The current restructuring at the BIPC has seen some staff resign and some disengage to reposition the company for efficiency and profitability.

The management in a statement made available to Economy Footprint said all company policies will be upheld and no staff will be unjustifiably treated in the course of the reconstruction.

The Statement titled “RE: NEPOTISM, POLITICS OF SACK: CALL ASEMAKAHA TO ORDER – AN APPEAL TO TOR TIV, GOV.ALIA, ASSEMBLY” read:

BIPC AN APPEAL TO ORDER (current (1)

“Our attention has been drawn to a baseless and deliberate misrepresentation of facts by some nefarious elements with a view to undermining the administrative efforts of the Management of Benue Investment and Property Company Limited in repositioning the Company on the path of profitability.

“As a going concern that places a high premium on information dissemination and public perception of her operations and reputation, we are compelled to provide clarification on the internal and process restructuring exercise to wit; Staff Liabilities: upon assumption of office, the current management of BIPC inherited an accumulated staff liability arising from unremitted statutory deductions and associated liabilities as follows:

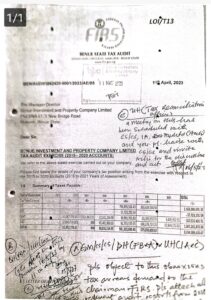

Tax Liabilities: N2.1 Billion Naira

VAT: N150Million Naira

Staff Gratuity: N168 Million Naira

Contributory Pension: N168, Million Naira

NSITF: N136 Million Naira

ITF: N79 Million Naira

FMBN: N600,000.000 Million;

and Union Check Off Dues, to say the least.

“The aforementioned liabilities unarguably threatened the operational existence of the company hence

management resolved to address them in order to remain afloat. Staff Retrenchment: The internal and process restructuring exercise is not targeted at a particular local government or individuals as erroneously alleged in the distorted publication. The exercise is, however, necessitated by the need to retain a realistic workforce based on the company’s financial strengths with a view to minimizing staff liabilities and operational losses as evidenced in the successive audited accounts.

“Suffice it to state that non-remittance of the referenced statutory deductions attract penal consequences by the various regulatory bodies on the supervising individual(s) and the organisation. In this wise, it is imperative for BIPC and her Management to refrain from such avoidable negative corporate acts if the company truly intends to accomplish her mission of being the leading investment company in North Central Nigeria in 2030.

“While the company is undergoing internal and process restructuring, it is important to state that most of the staff including but not limited to David Zaan, Usombo Terwase, and Emmanuel Kwaghvihi voluntarily resigned in the employment of the Company as such management could not compel them to remain in the employment of the company in line with the age-long principle of labour that you cannot force a willing employer on an unwilling employee.

“Selective Sanction of Erring Staff; The company’s condition of service, in clear and unambiguous terms, defined and accordingly outlined the procedure for the exercise of disciplinary action against erring staff of the company depending on the nature of the infraction as offences and punishment are prescribed thereof.

“By BIPC’s Condition of Service, the Managing Director can only implement recommendations of the Employee Disciplinary Committee in line with the outcome of their findings and not otherwise. Thus, the ill-fated allegations of selective sanction against the Managing Director is an exhibition of lack of elementary knowledge about corporate governance and mischief taken too far.

“Conversion of Contract Employment to Permanent Employment. Following a review of the circumstances of the conversion of contract employment of some staff to permanent employment, management was compelled to reverse the exercise because of non-compliance with the provisions of the Company’s Conditions of Service which requires Board Approval to be sought and obtained before carrying out the said exercise. Thus, the resolve of management to reverse the conversion exercise was not based on local governments or biological variables as erroneously alleged in the fallacious publication aimed at misleading the general public.

“Appointment of Forensic Auditors worried by the degree of loses in the company’s books of accounts occasioned by unsubstantiated and disallowable expenditures in violation of acceptable financial standards, management recommended the appointment of Forensic Auditor and the shareholder accordingly approved the appointment of PKF a tier 1 audit firm to audit the company’s accounts in the preceding years to unravel among others, the acquisition of 10 Laptop of 2GB for 11, Million Naira, Nyorgungu project estimated at 800 million Naira with 29 units uncompleted, acquisition of 100KV transformer at 62 Million Naira and the alleged payment of 10, Million Naira into Federal Mortgage Bank account in satisfaction of the facility that they granted to BIPC among others.

“The audit exercise commenced since December 2023, and the auditors are currently at the company head office reviewing the company’s books of accounts and allied financial records. In compliance with international best practices, the auditors recommended that certain staff who were directly involved in the despicable transactions should proceed on leave, pending the completion of the audit exercise. The temporary leave is neither a conviction nor approval of termination of appointment of the affected staff as alleged by the mischief makers but a routine process that is incidental forensic auditing.

“Contrary to the deliberate attempt by the mischief makers, as evidenced in their campaign of calumny against the Managing Director, we wish to categorically state that the Managing Director did not relate with staff on the basis of their local governments or whereabouts. For clarity of purpose and ease of reference, the Managing Director refused to employ personal aids upon assumption of office. Instead, he adopted staff that were employed and deployed to the office of the Managing Director by his predecessor.

“On the issue of departmental headship, it is important to note that routine internal posting and elevation to the position of Departmental Heads in the company under the supervision of the current management is based on satisfactory performance in line with the recommendation of the Head of Administration who is from Katsina-Ala local government and not clannish variables as alleged in the distorted publication. The public is therefore implored to disregard the alleged publication with a wave of hand.

“In specific response to the unfounded allegations of reckless spending, we wish of state that the Managing Director has stopped the payment of security allowance and weekly utility to top management staff and himself in order to reduce the company’s recurrent expenditures.

“On the whole, the public is invited to note that most of the company’s assets are nonperforming. Hence, her operations are solely dependent on the return on investment in the equity (shares) market. In this wise, there is a need to refrain from any temptation to divest the company’s shares in the equity market to offset liabilities occasioned by over bloated workforce and financial indiscipline.

“In the light of the foregoing and the fact that the company has been posting losses of 1.6 Billion for the past five years in addition to the fact that the performing assets have been leased by the Managing Director’s predecessors, the public is enjoined to disregard the campaign of calumny against the current management of BIPC by the mischief makers and await the outcome of the forensic audit exercise” it concluded.