The Central Bank of Nigeria (CBN) rising from its 302nd Monetary Policy Committee (MPC) meeting on September 22 and 23, 2025 reduced the benchmark monetary policy rate (MPR) by 50 basis points to 27 percent.

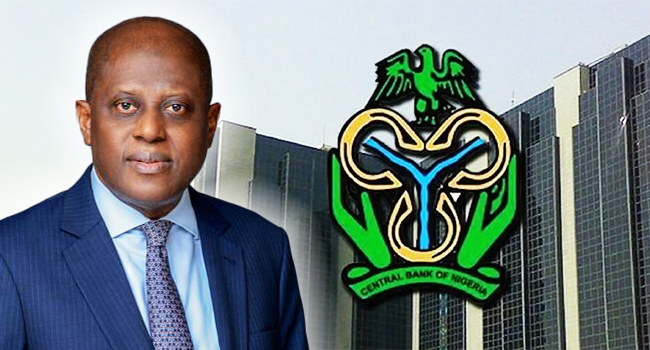

The CBN Governor, Dr. Olayemi Cardoso, while briefing the media on the outcomes of the meeting said the “Committee’s decision to lower the monetary policy rate was predicated on the sustained disinflation recorded in the past five months, projections of declining inflation for the rest of 2025 and the need to support economic recovery efforts.”

“The MPC also adjusted the Standing Facilities corridor to improve the efficiency of the interbank market and strengthen monetary policy transmission. The Committee further introduced a 75 per cent CRR on non-TSA public sector deposits for enhanced liquidity management” the CBN further indicated.

The CBN also adjusted the Standing Facilities corridor around the MPR to +250/-250 basis points in addition to the adjustment in the CRR for commercial banks to 45 per cent while retaining that of merchant banks at 16 per cent.

The Apex Bank during the meeting announced introduce a 75 per cent CRR on non-TSA public sector deposits and kept the Liquidity Ratio unchanged at 30.00 per cent.

The MPC expressed satisfaction with the prevailing macroeconomic stability, evidenced by the improvements in several indicators. These include the sustained disinflation, improved output growth, stable exchange rate and robust external reserves.

“It particularly noted the increased momentum of disinflation in August 2025, being the highest in the past five months. This deceleration, underpinned by monetary policy tightening, exchange rate stability, increased capital inflows, and surplus current account balance, have helped to broadly anchor inflation expectations” the CBN Governor said.

Other factors that contributed to the deceleration he said include the continued moderation in the price of Premium Motor Spirit (PMS) and the notable increase in crude oil production.

“In the view of the Committee, the stability in the macroeconomic environment offered some headroom for monetary policy to support economic recovery.”

“Members noted that effective functioning of the interbank market remains critical to enhanced transmission of monetary policy. This, therefore, informed the decision to adjust the width of the standing facilities corridor to boost interbank market transactions and enhance the stability of the market” he said.

The Committee acknowledged the continued stability of the foreign exchange market and its critical importance in achieving rapid disinflation, and therefore called on the Bank to continue the implementation of policies that would further boost capital inflows and deepen foreign exchange liquidity.

On the financial sector, the MPC noted the continued resilience of the banking system, with most of the financial soundness indicators remaining within their respective prudential benchmarks. Members also acknowledged the significant progress in the ongoing bank.

The CBN acknowledged the decline in headline inflation (year-on-year) which moderated further to 20.12 per cent in August 2025, from 21.88 per cent in July, driven by the decline in both food and core inflation.

On a month-on month basis, headline Inflation also decreased to 0.74 percent in August 2025 from 1.99 percent in the preceding month. Similarly, core inflation (year-on-year) eased to 20.33 percent. In August 2025, from 21.33 per cent in July, due to the slowdown in the cost of services, housing and utilities, as well as transport and logistics. Food inflation (year-on-year) also moderated to 21.87 per cent in August 2025, from 22.74 per cent in July, attributed to the decline in the prices of staples, especially rice, guinea corn, maize and millet.

On output, he said the recently released GDP for the second quarter of 2025 showed the sustained resilience of the Nigerian economy with a real growth rate of 4.23 per cent (year-on-year) compared to 3.13 percent in the first quarter of 2025.