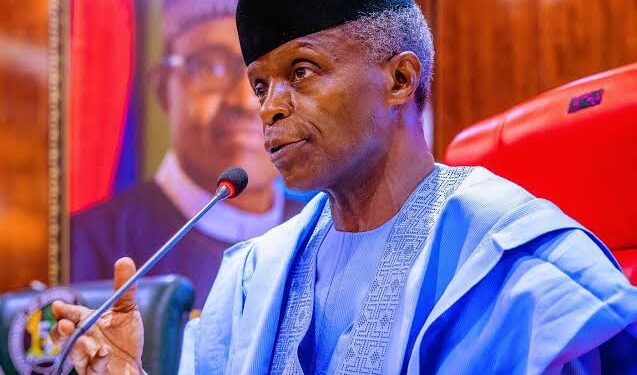

Vice President Yemi Osinbajo, has met with some players in the FinTech space, exploring possible ways of mitigating the hardship of the new CBN policy on Naira.

He advised the CBN and the banks to deploy more FinTechs and money agents to the hinterlands to address the worrying situation.

According to the VP “you need cash to pay for transport. For instance, in Abuja how do you take ‘drop or along’ or use a Keke NAPEP without cash, or buy foodstuff on the road or in canteens, or even buying recharge cards?

“Parents with kids in public schools give money daily to their children for lunch, most commerce is informal, so you need cash for most things,” Prof. Osinbajo pointed out” he said.

A statement by Laolu Akande, the VP’s publicist, said

During the virtual interactive session with a number of FinTech investors and ecosystem players, the Vice President said that the Central Bank of Nigeria and the commercial banks should work with all FinTechs that have mobile money agents, not just some of them, in order to reach the farthest places in the country.

According to him, “it seems to me that banks must engage their mobile money operators – FinTechs with mobile money licenses and many of them have micro-finance bank licenses now and already have a network of mobile money agents or human banks or human ATMs (as they are sometimes called) who are responsible to them and they can supervise by themselves. They can do currency swaps and open bank accounts.”

People need cash daily, most commerce informal – Osinbajo

Reading Time: 1 min read

0

Leave a Reply Cancel reply

FOLLOW US

BROWSE BY CATEGORIES

BROWSE BY TOPICS

2023 Benue Budget

Abuja-Kaduna Rail

Access Corporation

Access pension

airports concession

Aviation

Ayu

Benue Budget

Benue Community

Buhari

Business

CBN

Central Bank

Dana Air

Economy

FGPL

Herdsmen

Herdsmen attacks

insecurity

insurance

Maritime

Min of Transport

MSMEs

NAICOM

NCAA

Nigeria

Nigeria -Cameroon Border Post

Nigeria Air

NRac

Onne Port

ooh

Orrom

Ortom

PDP

PenCom

pension

Railway

Sambo Jaji

Transcorp

Transcorp Group

Transcorp Hotels Plc

UBA

Ukohol

Wike

Wildon Ideva

Economy Footprint

The EconomyFootprint is published by Ideas Tent Communications Ltd®. All Rights Reserved.