The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso has reiterated the CBN’s commitment to deepen financial stability, enable resilience and support economic diversification.

In a new month message on August 1, 2025 on his verified X handle (formerly twitter)

@olayemicardoso1, he said the bank’s focus remains clear: strengthen the system, enable resilience, and stay anchored in service.

“Each month” he said “brings new opportunities to deepen stability, rebuild trust, and shape the kind of economy Nigerians deserve.

“And building a resilient and diversified economy requires a dual approach: reinforcing our domestic financial core while forging strategic international partnerships. Our work in July reflected this clearly, with deliberate policy action at home and meaningful strides in strengthening Nigeria’s global economic relationships” he stated.

Speaking further on July activities he said: “At the 301st meeting of the Monetary Policy Committee, we unanimously agreed to maintain all key parameters, including the Monetary Policy Rate at 27.5% and the Cash Reserve Ratio at 50% for Deposit Money Banks. This was a deliberate decision, grounded in data and discipline, and designed to allow recent reforms to take full effect while sustaining our commitment to price stability”

“In a statutory briefing with the Senate Committee on Banking, Insurance & Other Financial Institutions, I reaffirmed our shared responsibility in safeguarding financial system integrity. Strong institutions require legislative collaboration, not only to enact sound policy, but to preserve the public trust on which it depends” indicated.

According to him, this domestic focus is yielding tangible results.

“The CBN is pleased to note that with the banking recapitalisation programme set to end in March 2026, eight banks have already exceeded the minimum capital requirement. This progress is a testament to the strength of our institutions and our collective commitment to a sound financial system.”

The Domestic Investors Summit he also said “provided an important opportunity to reaffirm the CBN’s commitment to building a financial system that listens, adapts, and works better. Domestic investors have held the line through periods of uncertainty; their resilience deserves clarity, consistency, and deeper collaboration.”

He commended the Federal Ministry of Industry, Trade and Investment for convening the summit and recognising that the lived experience of investors is essential to shaping policies that not only stabilise markets, but also unlock growth in the real economy.

On international partnerships he said the apex bank is “expanding the scope of international partnerships that can support Nigeria’s growth agenda.”

Thus, on the sidelines of the BRICS Summit in Rio de Janeiro, he met with the Brazilian Development Bank (BNDES), to discuss practical areas for collaboration, including infrastructure, export credit, SME financing, and climate-related investment.

These conversations he said are part of a broader push to diversify our financing partnerships across the global South and reduce structural vulnerabilities in our economy.

“We also welcomed a delegation from the World Bank, led by Anshula Kant, Managing Director and Chief Financial Officer, for high-level discussions on macro-financial stability and structural reform. As we continue to expand access and innovation in the financial sector, partnerships like this are critical to ensuring that inclusion and integrity go hand in hand” he said.

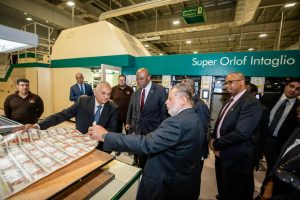

To further deepen international partnership, following Central Bank of Egypt Governor Hassan Abdalla’s visit to the CBN in June, an engagement that laid the foundation for deeper collaboration, the CBN Governor and his team undertook a working visit to the Central Bank of Egypt in Cairo.

The engagement highlighted regional monetary coordination and explored practical steps to strengthen institutional ties in support of shared development goals across the continent.

“I was particularly grateful for the warm hospitality extended during the visit, which included a tour of Egypt’s state-of-the-art banknote production facility, a remarkable showcase of technological innovation, operational precision, and national pride. This exchange has further cemented the foundation for continued collaboration between our two institutions in advancing Africa’s financial resilience and growth” Dr. Cardoso said.

:As I’ve often said, building a stronger financial system is not just about managing indicators. It is about restoring credibility, designing policy with clarity, and making room for the right type of ambition; the kind that supports a thriving economy and a more secure future” the CBN governor concluded.