57.4M persons have accounts in Nigeria – CBN data

By Aondowase Agabi

A Central Bank of Nigeria (CBN) Data show that 57,431,355 persons had accounts in Nigeria as at 31st March, 2023.

This is because only 57,431,355 Bank Verification Numbers (BVN) have been generated and linked to bank accounts in Nigeria.

The CBN regulation prescribed that only individuals with BVN can operate a bank account in Nigeria as part of know your customer requirements.

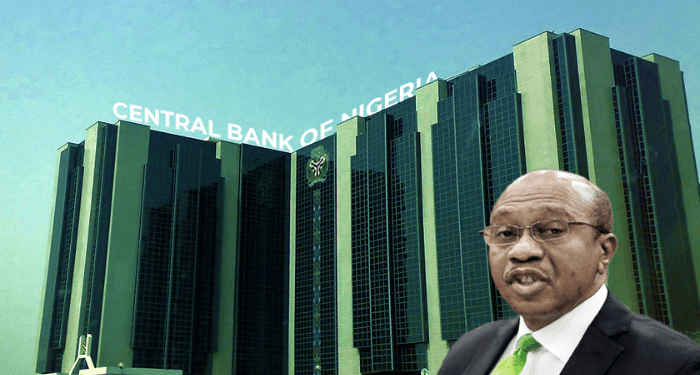

The CBN Governor, Mr. Godwin Emefiele gave the updated BVN numbers at the 34th seminar for Finance Correspondents and Business Editors held 2nd to 3rd May in Calabar, Cross River State.

“With a total enrollment of 57,431,355 as at 31st March 2023, the BVN is supporting the development of credit profiles for banking customers, which will assist in improving access to credit for credit-worthy borrowers by banks”

Emefiele, who was represented by the Director Monetary Policy Department of the CBN, Dr Hassan Mahmoud, said.

Find below the full text of the CBN Governor’s speech at the event.

A KEYNOTE ADDRESS

BY GODWIN I. EMEFIELE, CON

GOVERNOR, CENTRAL BANK OF NIGERIA

DELIVERED AT THE 34TH SEMINAR FOR FINANCE CORRESPONDENTS AND BUSINESS EDITORS

THEME: “Implementing a Robust Payment Architecture: Prospects, Opportunities and Challenges”

MAY 2, 2023

Calabar, Cross River State, Nigeria

1. It is my pleasure to address this morning at 34th Seminar for Finance Correspondents and Business Editors, holding in Calabar, Cross River State. The choice of this year’s theme “Implementing a Robust Payment Architecture: Prospects, Opportunities and Challenges,” is not only appropriate and well-conceived but also timely, given the evolving role of a robust payment ecosystem in the stability, safety and soundness of the global financial system. Seminars of this nature provide us with the opportunities to stay away from our beats in Abuja and Lagos, to interact face to face and exchange robust ideas towards gaining a deeper understanding and perspectives about the policies of the Central Bank of Nigeria. This would also assist us in reassessing our strategies in informing and educating our respective audiences on issues around the Nigerian economy and the country’s financial system, in particular.

2. Let me commend our staff of the Corporate Communications Department and the participating journalists for their effective collaboration that has successfully sustained this seminar series since its maiden edition in 1996.

3. Distinguished participants, as you are all aware, the global financial system is fast evolving, with different economic blocs and financial institutions introducing innovative solutions to make the global payment system more efficient, faster, transparent and safer for transactions settlement.

4. In many climes, the acceleration of digital payment options has caused brick-and-mortar offices to give way to electronic channels. Some of these channels include the automated teller machines (ATM), point of sales (PoS) terminals, internet banking, mobile banking, unstructured supplementary service data (USSD), and contactless payments. These products are designed to meet customers’ expectations of ease and speed, coupled with consideration for safety.

5. The Nigeria payment system landscape has particularly continued to record significant changes and development. We are all witnesses to the transformation that has taken place in the Nigeria payment system in the last decade. From heavy reliance on cash and daily visits to brick-and-mortar banks, we are now in a largely cash-less era, a project that commenced since 2012.

6. As a deliberate policy towards ensuring easier, cheaper and faster means of payments, the CBN has continued to collaborate with relevant stakeholders in the adoption of payment system instruments and channels, such as, the Bank Verification Number (BVN), the Real Time Gross Settlement System (RTGS), Regulatory Sandbox, Open Banking and the CBN Digital Currency (CBDC), the eNaira. Nigeria is currently the first country in the Continent and second in the world to have fully launched a live CBDC.

7. The payment system regulation and management role of the CBN is very critical in the achievement of its primary mandate of price and monetary stability conducive for inclusive and sustainable economic growth. It is also important for ensuring a stable, safe and efficient financial system in Nigeria. Cognisance of the implications of the risks that accompany digital innovations and technological advancement globally, the Central Bank of Nigeria, has continued to ensure a healthy balance between the adoption of latest innovations and development of reliable mitigants to the associated inherent and operational risks to both the payments system and the rest of the economic sectors in Nigeria.

8. Let me speak briefly on the role of the Central Bank of Nigeria in shaping the payment ecosystem in Nigeria, which is ranked among the top ten in the world in terms of its sophistication and robustness.

9. In our efforts to design a robust payments system in Nigeria, the CBN plays three critical roles, viz:

(i). As a Regulator

The Banks and Other Financial Institutions’ Act (BOFIA) 2020 and other enabling laws empower the CBN to regulate the banking and payments system towards ensuring a safe, stable and resilient systems. In this regard, the Bank licenses key operators in the payments system, maintains oversight on the participants and issues policies and regulations to support extant laws in enhancing payments system resilience. In performing this role, the Bank adopts a collaborative approach with other stakeholders.

(ii). As an Operator

The CBN operates the wholesale payments infrastructure, the Real Time Gross Settlement (RTGS) System. The system, being a key financial market infrastructure, operates in line with the Principles for Financial Market Infrastructure and local laws and regulations. This platform is key to ensuring an efficient and liquid settlement system.

(iii). As a Catalyst

The CBN, through the Payments System Vision (PSV) statements, helps in engendering innovation and wider adoption of electronic payments in different sectors of the economy. PSV 2020 was first issued in 2006 with the goal of driving the adoption of electronic payments across sectors and geographies in Nigeria. PSV 2025 was recently issued as a guidepost for the payments system until 2025. Its main goal is to expand payment options available to customers and strengthen regulation of the payments system.

10. The CBN has continued to initiate and implement several programmes to drive innovation and meet emerging market needs in the payment system landscape. A key objective is the use of the payments system as a tool to achieve the financial inclusion goals of the country.

11. Through these programmes, the CBN has successfully repositioned the Nigerian payments system to be highly competitive and acclaimed as one of the most innovative globally. Thus, many payment products that abound in the country are not readily available in some other countries. These include instant payments, QR codes and Central Bank Digital Currency, i.e. the eNaira.

12. These efforts have culminated into a significant increase in the total volume of transactions on Electronic Payment Channels. While the use of cash and cheques continued to diminish, web-based transactions such as POS, NIP, ATM and MMO have increased substantially. For instance, between 2021 and 2017, the volume of transactions via electronic channels such as ATM, POS, WEB, MMO and NIP increased by 99.76, 1,775.72, 35,502.58, 2,413.44 and 836.50 percent, respectively.

13. Some of the key CBN initiatives that accounted for the significant achievements in the payment system architecture are highlighted below:

14. eNaira – The advent of the Corona Virus pandemic (COVID-19) no doubt triggered rapid advancements in financial technology leading to speedy digitisation of money and finance. The CBN took advantage of the opportunity by launching the eNaira in October 2021. The eNaira was developed to broaden the payment possibilities of Nigerians, foster digital financial inclusion, with potential for fast-tracking intergovernmental and social transfers.

15. Since its launch, the CBN has continued to modify its features to make it more accessible to a wide range of users. Today, one does not need a smartphone to use the eNaira as it has become compatible with all generations of mobile devices (old and new). Till date, over 1.4m transactions have passed through the eNaira platform.

16. Open banking – Another initiative of the Bank is open banking aimed at expanding the cache of customer data warehoused in the financial sector for use in developing innovative products to service the needs of the public. The CBN will ensure that the data exchange will be done in a way to safeguard the privacy and concerns of the customers who own the data in the first place.

17. The opportunities presented by open banking are diverse and it serves to enhance financial inclusion and encourage healthy competition in the financial services space as well as promote efficiency.

18. Regulatory Sandbox – The Bank also initiated the Regulatory Sandbox to provide the opportunity for innovators to test their ideas and products to regulators in a controlled environment where the risks and potential of the products could be assessed. The Bank recently opened the first cohort of the sandbox. Startups with innovative ideas are invited to apply to the sandbox.

19. Cardless and other contactless payment options – The industry is quickly evolving towards cardless and other contactless payment options, including QR Codes, NFC etc. In this regard, the Bank has issued robust regulations to standardise operations of contactless payments in Nigeria. Through contactless payments, financial transactions can be consummated without physical contact between the payer and acquiring devices. It is an innovative payment option for safe and efficient conduct of low-value, large-volume payments.

20. Bank Verification Number (BVN) – The BVN has continued to feature in our KYC requirements as part of plans to ease the constraint associated with poor identification of banking customers. We have continued to support the aggressive enrollment of prospective banking customers in the informal sector onto the BVN system.

21. With a total enrollment of 57,431,355 as at 31st March 2023, the BVN is supporting the development of credit profiles for banking customers, which will assist in improving access to credit for credit-worthy borrowers by banks.

22. The BVN has also helped the industry in investigating fraud and other related crimes.

23. At this juncture, let me highlight some of the extant challenges faced by the Bank in implementing these initiatives:

i. Weak social infrastructure – Effective operation of payment platforms is highly reliant on stable telecommunication networks and power infrastructure. These are currently not optimal in Nigeria, thus, impacting the stability and resilience of the payments system.

ii. Activities of Unlicensed Entities – Some entities have continued to exploit access to information technology to engage in regulated activities without the appropriate licenses and authorisation.

iii. Cyber Threats and Fraud – The activities of fraudsters continue to threaten the resilience of the payment platforms. The confidence of the public is impacted by these activities. However, the collaborative effort between the Central Bank of Nigeria and other players in the industry is helping to curtail the nefarious activities of these fraudsters.

24. In response to the challenges posed by cyber threats, the CBN has put the following initiatives in place:

i. The Nigeria Electronic Fraud Forum (NeFF): consists of all relevant stakeholders, to proactively address challenges and safeguard the integrity of the e-payment channels.

ii. Payment Card Industry Data Security Standard: mandatory for any entity that processes, stores/saves or transmits payment card data.

iii. The Financial Industry Cybersecurity Fusion Centre: serves as a sectoral Computer Security Incident Response Team (CSIRT) for the Nigerian Financial Services Industry.

25. Other Initiatives against cybersecurity and fraud in Nigeria include:

i. Cybercrime Acts’ enacted in 2021 to address National Cybersecurity Policy and Strategy

ii. Endorsement of the SWIFT Sanction Screening Service & SWIFT Cross-border payments security (ISO20022 Standard) for banks.

iii. Risk-based Cybersecurity framework for Payment Service Providers (PSPs) and Deposit Money Banks (DMBs)

iv. Enforcement of Two-factor Authentication(2FA) requirement on all electronic banking products

v. Enforced the Installation of Anti-Skimming Device on ATMs

26. With these initiatives in place, the CBN has demonstrated irrevocable commitment to ensuring the stability and safety of the Nigerian payment system. Accordingly, we shall continue to deepen our oversight of the activities of operators in the payments system as well as ensure full compliance with regulations. In this regard, examiners and supervisors would continue to ensure that services delivered by participants meet required security standards.

27. The Bank will also continue to adopt a collaborative approach to achieve minimal cybersecurity threats in the payments system. A holistic mechanism for addressing cybersecurity threats requires policy and operational actions by all stakeholders. As you are aware, effective January 2023, the Bank issued a Risk-Based Cyber-Security Framework and Guidelines for Other Financial Institutions, to ensure their operational resilience in the face of cyber-security threats.

28. Distinguished participants, I am happy to note that this suite of initiatives have helped to open a vista of new opportunities in the payment ecosystem. With these revolutionary technological developments, the market has witnessed the deployment of new payment solutions. Artificial intelligence, quantum computing and contactless payments are some of the areas creating new opportunities for operators. The Payments System Vision (PSV) 2025, launched recently, also contains several recommendations aimed at driving implementation of some of the latest technologies to ensure the system’s resilience and safety.

29. We remain proud that the Nigerian payments and financial services sector is ranked among the best in terms of innovation, regulation and resilience. To sustain the successes achieved, the support of all financial institutions and stakeholders is imperative. In this regard, the CBN stand ready to continue to strengthen the institutional and regulatory frameworks that would encourage further development of the payments system and promote the usage of secure and credible electronic products as stipulated in the PSV 2025 strategic plan.

30. Distinguished Members of the Fourth Estate of the Realm, Ladies and Gentlemen, it is my expectation that at the end of your informed deliberations, participants would better appreciate the dynamics around implementation of a robust payment architecture. Hopefully, this will motivate you to become stronger advocates of our payment systems policies and initiatives, as well as all the measures put in place towards the discharge of the Bank’s mandate.

31. The Bank’s Management looks forward to suggestions, in the form of a communique, from this meeting, which we shall consider in strengthening the existing partnership between you and the Bank.

32. At this juncture, it is now my distinct pleasure to formally declare the 34th edition of seminar for Finance Correspondents and Business Editors open.

33. Thank you all for your attention.

Godwin Emefiele, CON

Governor, Central Bank of Nigeria

April 27, 2023

57.4M persons have accounts in Nigeria – CBN data

Reading Time: 9 mins read

0

Leave a Reply Cancel reply

FOLLOW US

BROWSE BY CATEGORIES

BROWSE BY TOPICS

2023 Benue Budget

Abuja-Kaduna Rail

Access Corporation

Access pension

airports concession

Aviation

Ayu

Benue Budget

Benue Community

Buhari

Business

CBN

Central Bank

Dana Air

Economy

FGPL

Herdsmen

Herdsmen attacks

insecurity

insurance

Maritime

Min of Transport

MSMEs

NAICOM

NCAA

Nigeria

Nigeria -Cameroon Border Post

Nigeria Air

NRac

Onne Port

ooh

Orrom

Ortom

PDP

PenCom

pension

Railway

Sambo Jaji

Transcorp

Transcorp Group

Transcorp Hotels Plc

UBA

Ukohol

Wike

Wildon Ideva

Economy Footprint

The EconomyFootprint is published by Ideas Tent Communications Ltd®. All Rights Reserved.

Recent News

CDS Charge Troops to Discharge Duty With Professionalism, Integrity

February 13, 2026

No Retired Army General Bears Alhaji Tijjani Rauf – Army Clarifies

February 13, 2026