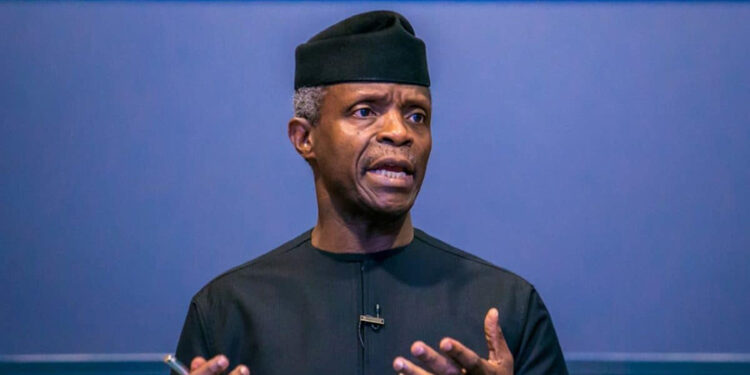

Africa requires the reform of global financial architecture as that would position countries in the continent to access Climate Change action funding, resources and ensure long-term adaptation according to the immediate past Vice President, Prof. Yemi Osinbajo, SAN.

He made this statement while fielding questions from journalists on Wednesday during a media chat at the just concluded first Africa Climate Summit, #ACS23, which took place in Nairobi, Kenya.

When asked about global taxes and reforms to international financial institutions to help fund climate change action announced at #ACS23, Prof. Osinbajo stated that “the reforms to the global financial architecture are crucial if Africa is to be positioned to access resources for immediate crisis response, long-term adaptation and resilience, and a green economic growth path.

“And this is urgent, as borrowing from capital markets is costing African countries 500% of what they would pay if sufficient capital was available from the World Bank. This could result in African countries paying an additional $56 billion in repayment costs on new debt raised between 2017 and 2021.”

Speaking on the outcome of the Summit, the former Vice President mentioned that one of the major takeaways from the summit is “the new framing of Africa not as a victim, but as a key solution to the climate crisis by pursuing a Climate Positive Growth Path as opposed to the carbon-intensive, more income, more emissions trajectory of the global North.”

He also reaffirmed his view on Africa being the first green civilization, pointing out that President William Ruto of Kenya also amplified that position, noting that “Africa with its untapped renewable energy potential, the world’s youngest and fastest growing workforce, and critical minerals and resources has the fundamentals to become a cost-competitive green industrial hub, greening both African and global consumption and removing carbon from the air.”

Regarding the use of carbon credits in tackling climate change, Prof. Osinbajo indicated that “it is essential that we join forces across borders and champion scalable solutions.

“Carbon credits could be a game-changer for Africa. It has the potential to unlock billions for the climate finance needs of African economies while expanding energy access, creating jobs, protecting biodiversity, and driving climate action.”

On the announcement of a $4.5billion finance initiative for clean energy projects in Africa from the UAE, Prof. Osinbajo said that mobilizing climate finance is vital for addressing the climate crisis.

His words: “The $4.5bn finance initiative announced by the UAE is a positive and commendable development. It reflects a commitment to addressing the pressing issue of climate change by investing in renewable and sustainable energy solutions in Africa which is essential for reducing emissions, creating jobs and driving social and economic development.

Prof. Osinbajo who is a global advisor to the Global Energy Alliance on People and Planet, GEAPP, engaged in several panel discussions, delivered remarks at a side-line event on “Powering Prosperity in Africa by Scaling DREs and Minigrids” as well as participated in a meeting with African and Global North Finance officials to discuss Special Drawing Rights (SDR) Allocation.

In addition, he interacted with leaders and stakeholders from around the world on the blossoming carbon market in Africa, its regulation and the carbon market activation being spearheaded by the Africa Carbon Markets Initiative, ACMI.

Climate: Osibanjo Calls for Quick Global Financial Architecture Reforms

0

Leave a Reply Cancel reply

FOLLOW US

BROWSE BY CATEGORIES

BROWSE BY TOPICS

2023 Benue Budget

Abuja-Kaduna Rail

Access Corporation

Access pension

airports concession

Aviation

Ayu

Benue Budget

Benue Community

Buhari

Business

CBN

Central Bank

Dana Air

Economy

FGPL

Herdsmen

Herdsmen attacks

insecurity

insurance

Maritime

Min of Transport

MSMEs

NAICOM

NCAA

Nigeria

Nigeria -Cameroon Border Post

Nigeria Air

NRac

Onne Port

ooh

Orrom

Ortom

PDP

PenCom

pension

Railway

Sambo Jaji

Transcorp

Transcorp Group

Transcorp Hotels Plc

UBA

Ukohol

Wike

Wildon Ideva

Economy Footprint

The EconomyFootprint is published by Ideas Tent Communications Ltd®. All Rights Reserved.